How have large corporations such as blackrock affected the housing market over the past 30 years, and how can we stop this change.

0 General Document comments

0 Sentence and Paragraph comments

0 Image and Video comments

Is BlackRock Really Buying Up Homes?

Yes, the giant institutional investor is acquiring them by the tens of thousands

By Ed McKinley

Americans want to know if Blackstone, the world’s largest alternative investment firm, is buying up tens of thousands of single-family houses and turning them into rentals.

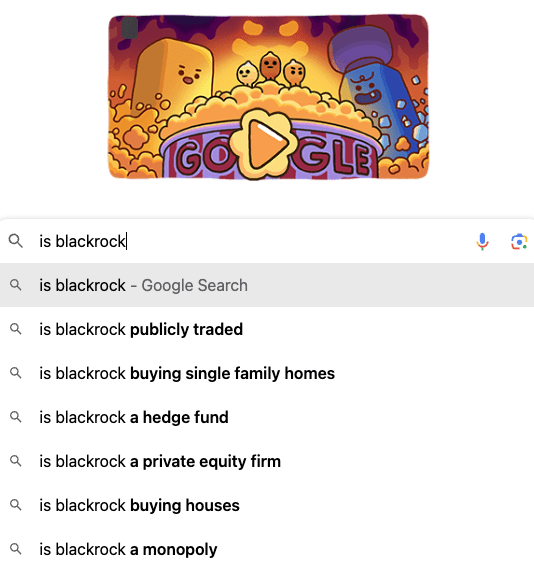

Don’t believe that’s a burning question? When we typed the words “is blackstone buying …” into Google search, the algorithm populated the question with “is blackstone buying homes …”

And the answer is an emphatic “YES!”

Blackstone (BX) became the third-largest institutional investor in single-family houses in May when it acquired 37,478 of them by buying Tricon Residential (TCN) for $3.5 billion or $11.25 per share.

That brought Blackstone’s inventory of houses to 61,964—still shy of privately owned Progress Residential’s first-place collection 83,502 and the Invitation Homes (INVH) second-place portfolio of 81,716, according to a Fast Company magazine perusal of Parcl Labs’ database.

The Tricon deal could be viewed as a step in Blackstone’s march back into upper echelon of the business.

Blackstone started Invitation Homes in 2012 to buy houses in the wake of the foreclosure crises, a report from the Cal Mattersnews website said. It sold its shares in the company seven years later for $7 billion, more than twice what it invested.

In 2021, it paid $6 billion for Home Partners of America, which owned 17,000 houses at the time. With the recent Tricon purchase, Blackstone was nearly back to the top.

But what else do we know about Blackstone?

Powerhouse siblings

Blackstone had more than $1 trillion in alternative assets under management as of May 2024. “Alternative” can include just about anything other than stocks and bonds. The company deals with so many of those alt asset classes that some refer to it as “the world’s largest private equity firm.”

And that’s no understatement. The entire private equity industry manages $7.5 trillion in assets, according to the Private Equity Stakeholder Project, or PESP, an organization that tracks the influence of such firms. That means Blackstone controls 13.3% of the industry’s assets.

Blackstone was founded in 1985 as a mergers and acquisitions firm and later invested in healthcare, technology, energy, media and other companies. It began acquiring positions in commercial real estate, like national motel chains, in 1991.

But be advised Blackstone isn’t the same thing as BlackRock (BLK).

Blackstone started BlackRock as an asset management company in 1988 and spun it off as a separate entity in 1992. (Yes, the principles have admitted the wordplay struck them as humorous.)

Anyway, BlackRock has grown into the biggest investment manager in the world. It works with institutional and individual investors, specializing in fixed-income investments like bonds and mortgage-backed securities. It also owns the iShares line of exchange-traded funds.

But let’s go back to the original company, Blackstone, for a moment.

Blackstone catches flak

Blackstone doesn’t always have the best of intentions when it rents out its houses and deals with its tenants’ problems, according to Tablet, an online magazine. In fact, giant landlord is accused of a host of sins.

“The goal of institutional investors like Blackstone is to optimize profits,” the Tablet article said. “On the ground, that translates to maximum allowable rent increases, evictions, the rise of hidden fees, a reduced investment in complex maintenance, and even efforts to influence state and local housing policy.”

While Blackstone deals with that sort of criticism, BlackRock tries to skirt the issues. The latter insists on its website that it buys only multifamily housing. “Bottom line: BlackRock is an active investor in the real estate market,” the company’s disclaimer reads, “but we are not among the institutional investors buying single-family homes.”

Some might find that statement misleading. Writers on the investfourmore.com website had this to say: “While it is true that [BlackRock] does not own houses or own companies that own houses, they do invest in companies that own houses.” Blackrock owns 6.7% of American Homes 4 Rent (AMH), for example, which controlled 59,000 homes in the United States as of December 2023.

So much for Blackstone and BlackRock. But even if neither owns all or part of the domicile you rent, you could still be subject to the control of any of a score of institutional investors buying up housing.

The big guys

Besides the two Black former siblings, heavyweights like J.P. Morgan Asset Management and Goldman Sachs Asset Management have helped bankroll an industry of more than two dozen single-family home rental companies, said Toptal, a freelancing platform for tech workers.

Major players among those companies have included Pretium (PVG), Opendoor (OPEN), Offerpad (OPAD) and privately-held Amherst.

Until 2011, no single investor owned more than 1,000 single-family homes, according to Government Accountability Office (GAO) studies reported on the National Low Income Housing Coalition website.

But that was about to change, as noted by NerdWallet. “The 10 biggest institutional investors owned more than 430,000 single-family rental homes at the end of 2023, and they continue to acquire houses to rent out to middle-class families,” the organization said on its site.

Those 10 largest institutional buyers collectively purchased 1,500 to 3,500 homes per month last year, as shown by an SFR Analytics study cited on the Housingwire website.

But is that really a lot of houses in nation of 333.3 million people? The Census Bureau notes renters occupy about 15.9 million single-family homes, about 3% of the nation’s total. That means most houses aren’t rentals, and institutional investors own only a small percentage of the houses that are up for rent.

So, the big guys probably aren’t fixing rental prices on a national level. Still, their holdings are concentrated in a few metro areas, mostly in Florida, Georgia, the Carolinas, Texas, Arizona and California, giving them a great deal of leverage in a relatively few places.

Georgia’s biggest city is where institutional investors flex their power to perhaps the greatest degree. “In metro Atlanta, just three companies owned 19,000 houses at the beginning of 2022, for an 11% market share,” NerdWallet notes.

Institutional investors may own even bigger shares of some markets than estimates indicate. The GAO says such companies possess 25% of the single-family rental houses in Atlanta; 21% in Jacksonville, Florida; 18% in Charlotte, North Carolina; and 15% in Tampa, Florida.

Whatever the percentages may be in those places, they’re large enough to alter the lives of renters, a situation that hasn’t gone unnoticed.

General Document Comments 0

on the uploaded document.

on the uploaded document.

0 archived comments